标题:Matching Price Stickiness and MPC: Monetary Policy Implications

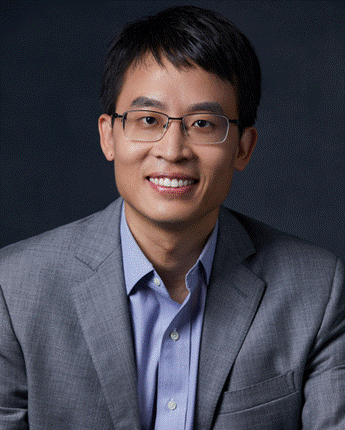

主讲人:李明浩博士

李明浩博士是北京大学国家发展研究院的助理教授。主要研究领域是宏观经济学和货币经济学;他的研究兴趣集中在货币政策的传导机制,以及宏观经济中的生产网络和信息摩擦。目前主持一项国家自然科学基金青年基金。

讲座时间:2023年10月17日 星期二 下午14:00-15:30

讲座时间:学院楼3号楼127会议室

主持人:黄志刚教授,金融学院金融学系系主任

内容摘要:This paper documents a negative relationship between households’ marginal propensity to consume (MPC) and the price stickiness of goods they purchase. Households with larger MPC consume goods whose prices are on average more flexible. This group of households experience higher inflation after an expansionary monetary policy shock. We embed this negative relationship into a tractable multi-sector Two-Agent New Keynesian (TANK) model, and show analytically that it dampens the potency of monetary policy. Quantitatively, the real effects of monetary policy are 15 percent less compared to a benchmark model with homogeneous consumption baskets. The optimal monetary policy differs qualitatively from what it would be in its TANK counterpart. Introducing heterogeneous consumption baskets leads to intrinsically inefficient flexible-price equilibrium, and generates a new type of sta- bilization v.s. redistribution tradeoff.

本讲座受到第七批青年科研创新团队支持计划资助。

撰稿:郭俊杰

审核:彭俞超